How to Start the Cryptocurrency Market and How to Create an Investment Portfolio?

There are important points to consider before deciding to invest in the cryptocurrency market. Cryptocurrencies are highly volatile and involve risks, so you need to act responsibly.

Conduct Research

You should not invest without having basic knowledge about cryptocurrencies. Study popular cryptocurrencies and projects such as Bitcoin, Ethereum, Ripple. Try to understand how each of them works, their technologies and intended use.

Evaluate Your Own Financial Situation

Review your financial situation before investing in cryptocurrency. Determine the money you can invest and make sure you are ready to lose this money. Due to the volatility of cryptocurrencies, you should not forget the risk you can lose when investing.

Choose a Reliable Crypto Exchange

You should choose a reliable crypto exchange to buy and sell cryptocurrencies. It is important to choose an exchange that complies with the legal regulations and security standards of our country. Pay attention to the exchanges' user reviews and security measures.

Apply the Diversification Principle

Avoid putting all your investment in a single cryptocurrency. You can reduce risks by diversifying your portfolio. You can reduce your overall risk by creating a portfolio distributed among different cryptocurrencies.

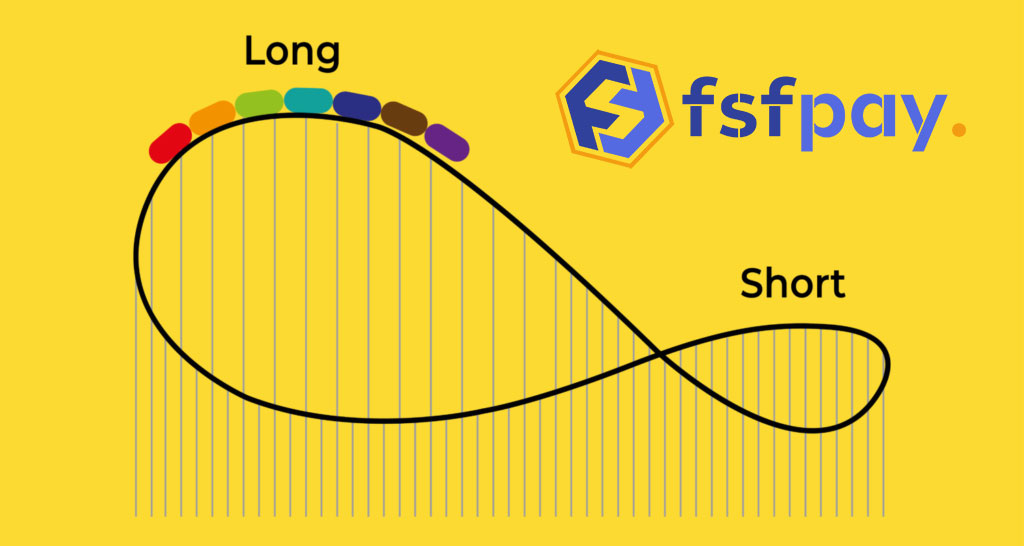

Set Long-Term and Short-Term Goals

Consider whether you want to make your cryptocurrency investment a long-term or short-term investment. Long-term investments can often be less stressful, but short-term investments may offer more earning opportunities.

Research and Monitoring

Cryptocurrencies have a rapidly changing market, so it's important to keep up with updates and news before investing. You should keep up to date with project updates, price changes, and general crypto market trends.

Take Security Precautions

You should take security measures to keep your cryptocurrencies safe. Consider secure storage options such as cold wallets and keep your passwords strong.

Monitor Your Investment and Make Adjustments

Review your portfolio regularly and make adjustments when necessary. Monitor the performance of your investment and update your strategy.

Investing in cryptocurrencies can be risky, but if you prepare properly and act deliberately, you can potentially be profitable.

Random Post

What is a Long & Short Po...

There are terms that everyone who enters the cryptocurrency market has heard since day one, but they always confuse them. The two most intriguing terms are "long and short posit...

What is Open Source Code?...

When we say what is software; The concept of software, which almost everyone interested in technology has a piece of knowledge, is the essence that enables the operation of many...

How to Secure Your Bitcoi...

Bitcoin and cryptocurrencies have undoubtedly started to change the understanding of modern finance. Many people talk about how secure and transparent the Blockchain is. However...